RAM Prices 2026 in a State of Emergency: Why DDR5 is So Expensive – and What Your IT Needs to Know

RAM Prices Skyrocket: What’s Happening in 2026?

RAM prices are rising sharply in 2026 and fluctuate sometimes weekly because global memory demand—especially from AI data centers and DDR5 platforms—exceeds supply, while manufacturers shift production to more expensive high-end segments. For companies, this means: memory has transformed from a previously predictable standard component into a volatile cost factor that noticeably affects IT budgets and project timelines.

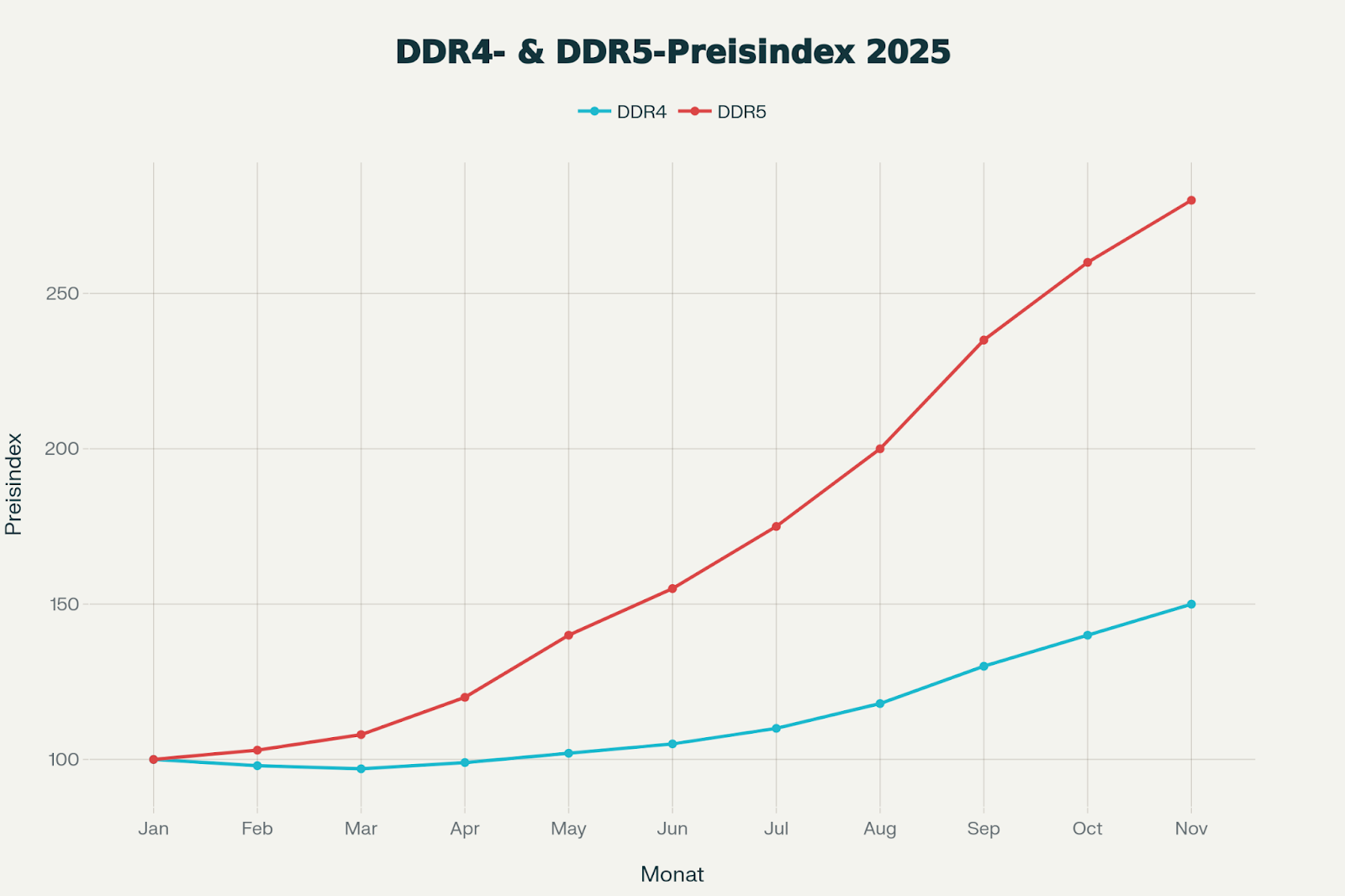

The combination of surging demand and limited production is causing RAM prices—especially DDR5—to increase by over 100% in some cases compared to the previous year, with week-to-week fluctuations. While DDR4 remains somewhat more stable, modern DDR5 kits are often several times more expensive than they were in spring, which particularly impacts upgrades and new purchases with large memory requirements.

Almost all leading manufacturers are now publishing official notices about rising RAM prices:

Are flash memory devices also affected by price increases?

Flash is currently one of the most sought-after commodities in the technology sector alongside DRAM, as demand for data storage is very high due to AI workloads. According to DigiTimes, Sandisk increased its contract prices for NAND flash by 50% in November to adjust to supply and demand dynamics.

Similar to the dramatic increase in DRAM prices, which rose 172% compared to the previous year, NAND flash could follow a similar trend. This announcement has prompted several module manufacturers to suspend shipments while they reassess their prices and customer commitments. Industry giants such as Transcend, Innodisk, and Apacer Technology are among those that have temporarily suspended shipments.

Transcend, in particular, has suspended new orders and outgoing shipments since November 7 to evaluate its next steps. The company also expects the NAND flash shortage to continue for a while, with prices rising for an indefinite period before eventually stabilizing at a more reasonable level.

AI Boom: Why do data centers need more RAM now?

Data centers need a lot more RAM now because modern AI, cloud, and real‑time analytics workloads keep much more data and many more models in memory at the same time than traditional applications ever did. At the server level, the average DRAM (and HBM) capacity per node keeps rising so GPUs and CPUs are never starved of data and can run at high utilization.

The global AI boom is driving hyperscalers, cloud providers, and large enterprises to purchase enormous amounts of DRAM and High Bandwidth Memory (HBM) for GPU clusters and large language models. This demand consumes a significant portion of available production capacity, leaving less volume for traditional PC and server RAM and driving prices up across the supply chain.

At the same time, many new AI platforms rely on extremely fast and dense memory solutions, motivating manufacturers to prioritize these high-margin products. Standard memory for desktops, workstations, and small servers is therefore directly affected by the AI investment wave and reacts sensitively to any shifts in the data center market.

DDR5 Instead of DDR4: Platform Shift as a Price Driver

Industrial‑grade DDR is built for “hostile” environments and long, predictable use, while standard consumer DDR is optimized for low cost and speed in relatively friendly conditions.

Current desktop and server platforms from Intel and AMD increasingly rely on DDR5—sometimes exclusively—raising demand precisely in the segment with the tightest supply. Companies migrating to modern platforms must inevitably purchase DDR5 in a market where supply and demand diverge significantly.

Memory manufacturers are also deliberately shifting some capacity from DDR4 and consumer DDR5 to server DDR5 and HBM, where higher margins are possible. This reduces the available amount of "standard" DDR5 RAM for end customers and system integrators, further increasing price pressure.

Samsung focused heavily on AI-driven growth, HBM4 development, and strategic positioning against competitors. The company is intensifying efforts to regain leadership in the HBM segment, where SK Hynix has recently gained ground. It also presented AI-optimized DRAM and NAND solutions on the roadmap, emphasizing scalability and energy efficiency for data centers and HPC applications.

SK hynix officially started mass production of HBM4, featuring 36GB per chip and up to 2TB/s bandwidth. This memory is optimized for NVIDIA’s Rubin AI accelerators, offering up to 60% speed improvement over previous generations. It’s also designed to meet the demands of AI servers, data centers, and edge computing.

Key Industrial-Grade Manufacturers

Key industrial‑grade DRAM is produced both by specialized industrial vendors and by some large memory makers offering dedicated industrial lines. Typical brands you’ll see in industrial PCs, embedded systems, automation and transport are:

- ADATA – Focus on industrial DRAM modules with long‑term availability, wide‑temperature ranges and fixed BOM; broad DDR1–DDR5 portfolio for embedded/industrial use.

- Innodisk – Industrial DDR5/DDR4/DDR3 modules for mission‑critical and harsh‑environment applications, including wide‑temp and very‑low‑profile (VLP/ULP) variants.

- Apacer – Strong in industrial SO‑DIMM/DIMM, wide‑temperature and ECC modules for IPCs, automation, transportation and networking.

- Intelligent Memory – Offers commercial and industrial‑grade DDR, including DDR5, with extended temperature options and long‑term support.

Numbers & Trends: How Strong Are the Price Jumps?

Market reports show that contract prices for DRAM have risen by well over 100% in a single year, with some segments experiencing more than 150% growth. In retail, this translates to DDR5 kits that are now significantly more expensive depending on speed and capacity than identical products a few months ago, while DDR4 follows more slowly but noticeably.

Particularly notable are 32 GB and 64 GB DDR5 kits used in workstations, gaming PCs, CAD, or AI systems, as they fall right into the “sweet-spot” of demand. In these cases, the timing of a single order can determine whether a project stays within budget or exceeds the planned costs.

Chart: “Average DDR4 and DDR5 RAM Price Index 2025 (synthetic)”

Price Lottery: Why RAM Changes Weekly

RAM prices currently behave like stock market quotes due to multiple overlapping dynamic factors: short-term adjustments in manufacturer pricing, bulk deals, fluctuating inventories, and currency effects. The result is a market in which the same modules can increase significantly in price over a few weeks—or temporarily drop during promotions.

For IT buyers, this means that "waiting for the perfect time" is increasingly difficult, as multiple price waves can hit within a single month. Active market monitoring and a flexible procurement strategy become essential to avoid or mitigate price spikes.

Impact on Your IT Planning

- Rethink budgeting: RAM in 2026 is no longer a stable standard item but a volatile cost driver that should be factored in with price buffers and alternative scenarios.

- Leverage DDR4 infrastructure: Where technically possible, expanding existing DDR4 systems can be more economical than immediately switching to a fully equipped DDR5 setup.

- Phase project expansions: Large RAM upgrade projects can be divided into stages—first a sensible baseline, later expansions when budget, demand, and market conditions align.

Especially for memory-intensive applications such as virtualization, databases, AI workloads, or in-memory analytics, it makes sense to plan capacity targets (e.g., 128 GB, 256 GB, 512 GB) in multiple stages. This ensures system scalability without purchasing maximum configurations at the least favorable price point.

How We Support You

As your partner focused on RAM, server, and industrial hardware, we continuously monitor memory prices, analyze market reports, and anticipate when conditions tighten or relax. We use this market transparency to advise clients on platform selection, RAM configuration, and procurement timing, ensuring projects remain technically and economically viable.

Considering expanding your existing DDR4 systems or switching to DDR5?

Planning a new ERP or database server and need clarity on realistic RAM budgets?

Acquiring AI workstations or GPU servers and want to avoid costly misplanning?

We can analyze your requirements, compare platform options, and develop a procurement strategy that keeps your IT efficient while accounting for current RAM price risks.

Conclusion: RAM Remains a Bottleneck in 2026—but Manageable with the Right Strategy

RAM prices in 2026 reflect a structural shift: the AI boom, platform transitions, and production relocation meet high baseline enterprise demand. Companies that treat memory as a strategic resource, plan procurement consciously, and rely on expert advice can execute reliable IT projects despite the “RAM shock”—without being thrown off by weekly fluctuations.

FAQ: RAM Prices 2026 and What They Mean for Your IT

Why are RAM, especially DDR5, prices so high right now?

Prices are rising because global memory demand—driven by AI data centers, cloud providers, and modern server platforms—is growing faster than available production capacity. Manufacturers also prioritize high-margin products like server DDR5 and HBM, making traditional PC and workstation RAM scarcer.

Why do RAM prices sometimes change week to week?

RAM is heavily influenced by the spot market: large single orders, fluctuating contract prices, currency rates, and inventory levels make procurement prices highly dynamic. These movements are reflected with a slight delay in end-customer prices, making RAM prices behave almost like stock quotes.

Does this only affect DDR5 or also DDR4 and server RAM?

The main pressure is on DDR5, as new platforms primarily rely on it, but DDR4 and server RAM are also affected due to production shifts and resource reallocation. High-capacity server modules (e.g., 96 GB, 128 GB DDR5 RDIMM) are particularly scarce and disproportionately expensive.

How does this affect my planned PCs, industrial PCs, or servers?

High-RAM configurations—ERP servers, database backends, virtualization hosts, AI workstations, or industrial PCs with ample buffer—are now significantly more expensive than calculated a few months ago. The higher the planned memory (128 GB, 256 GB, 512 GB), the stronger the impact of price jumps.

Should I wait until RAM gets cheaper?

Whether waiting makes sense depends on your timeline and project criticality: forecasts indicate persistently tight conditions, with short-term drops possible but not guaranteed. Often a middle ground works best: start the project but do not purchase the maximum RAM upfront—plan for staged upgrades.

Is it worth expanding existing DDR4 systems?

Yes, in many cases, selectively expanding DDR4 platforms is economically more sensible than immediately switching to entirely new DDR5 systems, especially if existing hardware still has sufficient performance headroom. For new platforms, DDR5 is usually unavoidable, particularly for servers and long-term systems.

Can I start with less RAM and expand later?

This is often the most pragmatic solution: plan systems with free RAM slots for future upgrades without changing the platform. This allows starting with a functional baseline and expanding as budget and market conditions allow.

How much RAM do I need for my use case?

This depends heavily on the scenario:

Office/Standard clients: typically 16–32 GB.

High-performance workstations (CAD, data analysis, AI): 64–128 GB or more.

ERP, database, or virtualization servers: often 128–512 GB, depending on load and number of VMs/databases.

A precise needs analysis helps avoid under-provisioning or over-provisioning.

How can I mitigate the risk of volatile RAM prices?

Possible measures include staged expansions, alternative RAM configurations (e.g., different module sizes), flexible project timing, and— for larger volumes—framework contracts or early reserved quotas. Active market monitoring and timely action against anticipated price increases also help.